We Need a Better Homeownership Society

Americans will always dream of owning. But we can convince them they should want low and stable prices.

Dear readers,

A key reason I’m a political moderate is I think we need to be humble about the likelihood of change, especially when we’re talking about changing people’s personal preferences and values. This comes up a lot when we talk about climate and environment — if you need to achieve important changes related to emissions, it’s best to look for ways to do it that don’t involve asking people to give up goals or practices that are important to them, like driving. “Ban cars” lectures are interesting to very few people.

I have closely related feelings about housing and homeownership.

Jerusalem Demsas has a widely read essay for The Atlantic saying “you should be wary of the mythos that accompanies the American institution of homeownership,” adding “Homeownership doesn’t even consistently deliver on the core promise of providing financial security. And, crucially, pushing more and more people into homeownership actually undermines our ability to improve housing outcomes for all.”

I find much to agree with in the essay. Demsas says housing is “consumption, not investment,” which is something I say frequently enough that my husband rolls his eyes at me when I do. I wrote about that view in a Mayonnaise Clinic issue earlier this year. I also agree that policy and social factors have pushed some people into homeownership who should have rented, sometimes with disastrous consequences for household finances. And I think we should make renting more attractive, though I’d quibble with her ideas about how to do that.1

But I’m reluctant to take the culture of homeownership head-on when I think we can focus more directly on the biggest problem with the culture: that it can end up pushing voters toward policies that push up prices by constricting the supply of housing. I would draw a distinction:

We will fail if we try to talk the public out of the idea that owning a home is generally better than renting one, or out of the idea that owning is more prestigious than renting, or out of the idea that owning a home is a symbol of stability or having “made it” that people should aspire to. People have emotional feelings about homes and homeownership, many of them only very tenuously related to government policies to promote homeownership.

I do believe we can talk people out of the idea that ever-rising real home prices are desirable, or that public policy should promote rising real prices. Indeed, I think we’re already having some success at talking people out of this — because while ever-rising prices are disastrous for people who don’t own homes, they’re not even really any good for people who do. We can even succeed at changing this attitude without unwinding much of the policy apparatus that prefers owning over renting.

Housing is consumption. Consumers should always prefer low prices, even if they consume by owning.

A house is a depreciating asset that should decline in value over time.2 Really, buying a house should be a lot like buying an expensive car that lasts a really long time — the purchase has “investment” characteristics, in that you’re putting out money now to provide yourself benefits later, but those benefits should be coming in the form of consumption (your use of the car or the house) not through increases in asset value.

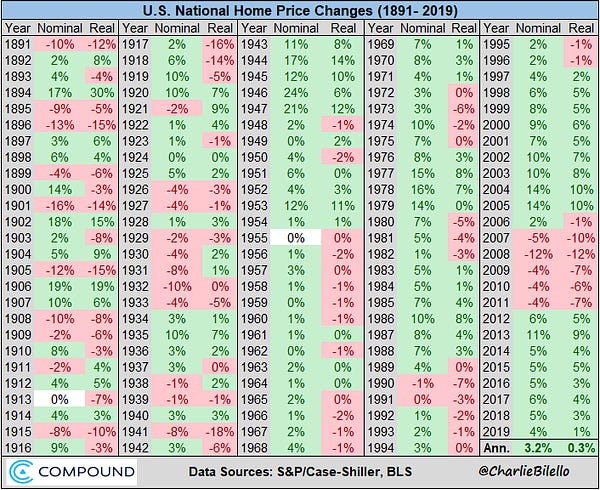

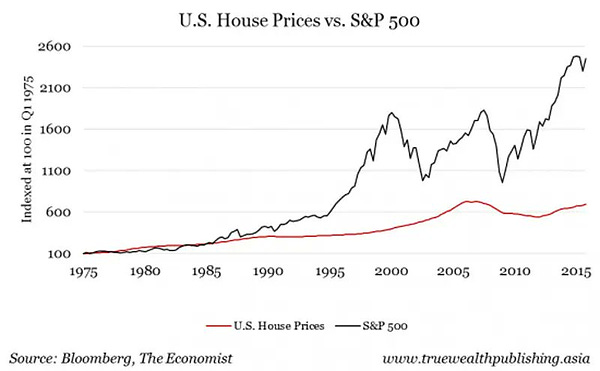

People sometimes seem to literally forget that the main benefit of owning a house is the use of the house. They’ll post things like this, comparing average returns on homes to the S&P 500, without noting that you can’t live in a mutual fund:

This goes to Demsas’ point: even though people shouldn’t expect their homes to perform like stocks, people have come to have this expectation, and that’s bad both for them and for society. It would be better if they thought of them more like they think of cars.

Of course, as we saw during the pandemic, it is possible for cars to appreciate if there is a supply shock that restricts the supply of new cars. Similarly, when homes consistently appreciate, that tends to be because of a screwed up policy environment that has prevailed in many economically prosperous metropolitan areas over the last few decades: Excessively restrictive land use policy causes homes to become increasingly scarce relative to demand.

It’s bad if homeowners end up lobbying for this, just like it would be bad if we tried to restrict the production of new cars in order to push up used car prices. And yet, widespread car ownership has not led to an entrenched lobby of car owners trying to prevent the production of new cars, and I think the reason why is instructive.

The thing about persistently rising real home prices is that, while they are a disaster for people who need to buy homes, they're no great shakes for people who already own them. Sure, if your house rises in value, you become wealthier on paper. But if you sell your house, then you don’t have a house — effectively, your increased wealth is tied up in financing the increased implicit cost of living in the house you already live in. Homeownership is a hedge against rising housing costs — this is one of the valid reasons people prefer owning over renting — but a hedge simply means that homeowners are largely held harmless from housing cost increases, not that they benefit from them.3

Obviously, this doesn’t describe every situation. It’s easy to come up with scenarios where homeowners come out ahead from rising prices — a professional who sells a sharply appreciated home in an expensive area and retires somewhere cheap; an empty-nester who can trade down from a large house to a small one. But that doesn’t always work, as Demsas notes when she talks about luck — some of the popular retirement areas in Florida have gone up in price alongside the northeastern metropolitan areas that retirees move from. More importantly, those winning homeowners live in a society. That empty-nester can trade down and pocket some cash, but she also presumably has children with growing families whose housing needs are increasing while prices also increase.

All of which is to say, I don’t think it’s as hard as people sometimes fear to convince people who own homes that they shouldn’t want home prices to go up, up, up. Some of us are housing investors, but we’re all housing consumers, and the consumer side of each of us loses when prices rise.

Demsas notes with some dismay a 2021 Boston University survey of mayors of cities with populations over 75,000, which found only 40% of mayors agreed that “it would be better if housing prices in my city declined.” But as she also notes, that was approximately a doubling from 2018, when only 20% agreed with that statement. This reflects an amazing amount of elite opinion change in a short period — the pandemic-driven spike in home prices coupled with concerted pro-housing-supply advocacy efforts appear to have borne fruit. In California, this elite opinion change has also been turning into good, pro-supply policy output from the state legislature.

Who knows where these numbers will be three years from now? Maybe we’re well on the way toward an elite consensus for cheaper, more abundant housing — even though that consensus is heavily led by people who are themselves homeowners.

NIMBY is about more than prices

If artificial supply constraints that push up home prices aren’t even that good for homeowners, why do homeowners want artificial constraints on housing supply?

I think it’s worth taking people at face value here: Often, they are concerned about traffic and parking and light and views and “the character of the neighborhood,” whatever that means to them. They like how things are and they don’t want them to change. They understand that more housing is needed, but it should be somewhere else.

There are problems with all of these arguments, but people do feel them sincerely, and they will still feel them even if you change their minds about how they should want prices to move. Some renters feel these things and engage in NIMBYism, even when it would appear to be in their financial interest to flood the market with supply and push down rents.

So while I agree with Demsas about the importance of promoting pro-housing-supply politics, I’d just say I think the political question of deregulating land use is somewhat orthogonal to the question of whether rising prices are good. We should try to convince people to want to allow bigger buildings, and we should try to convince people not to want prices to rise, but voters are likely to view those as separate questions even though allowing more buildings should in fact push prices down.

A pro-supply housing politics would be likely to reinforce homeownership norms instead of weakening them

Finally, I’d disagree with Demsas’ implication that a society where housing was more plentiful would be one where more people would feel comfortable choosing to rent.

I am not opposed to pro-rental messages. I am myself a renter by choice — we could afford to buy an apartment in the city, but we prefer to rent and we do so — and particularly, I think it’s good to try to talk people out of overextending themselves by buying homes that are too expensive or expose them to too much financial risk.

But I think most people have thought a fair bit about how they want to live and I’m not sure how likely they are to be talked out of ownership as a life goal. I also think the biggest reason people rent is that they cannot afford to buy. Lower prices would make it affordable for more people to own instead of renting, so I suspect if housing got cheaper, an even larger fraction of Americans would become homeowners, and the sense that owning was the right thing for an established adult to do would only get stronger.4

And I don’t have any problem with that. I think there are aspects of the culture of homeownership — such as people’s desire to take pride in property they control, and the added feeling of investment in a neighborhood that comes with ownership — that are good. And I believe we can convince homeowners that affordable and abundant housing is in their interest because, like everyone else — their children, their coworkers, their friends, their employees — they are house consumers. A better culture of homeownership is possible, and I think many of the arguments in Demsas’ piece — which we increasingly see carrying the day in capitals like Sacramento — can help push us in that better direction.

I’ll be back tomorrow with an issue of the Mayonnaise Clinic, including some questions on holiday travel. If you have last-minute issues to raise, please send them in to mayo@joshbarro.com.

Very seriously,

Josh

Demsas says, “If we are interested in helping low- and middle-income people live well, we need to fix renting. Some potential policies include increasing oversight of the rental market, providing tenants with a right to counsel in eviction court to reduce predatory filings, advancing rent-stabilization policies, public investment in rental-housing quality, and, most important, building tons of new housing so that power shifts in the rental market from landlords to tenants.” My main objection here is that, if you want to foster a stronger and larger rental sector, you don’t just need to make consumers want to live in rental apartments, you need to make developers want to build and maintain rental apartments. Some of these policies — especially rent stabilization and rules that make evictions more challenging — will tend to push developers in the direction of building condominiums or converting rental apartments to condominiums.

It’s important to remember that improvements capitalize into your cost basis in a house. If you renovate over and over again, the house shouldn’t decline in value. But each of those renovations is more capital you’re pouring into the house in order to maintain its value.

This is why car owners do not lobby for policies to prevent the production of new cars — since they need to drive, it would be self-defeating. I guess it’s harder for people to understand this with houses because houses last longer, but we just need to encourage the same type of thinking.

In fact, since the main reason we rent in the city is that we think for-sale apartment prices are unreasonably high relative to rents, we’re another household that would likely switch to owning if prices fell.

Another area that gets too little focus (imo) is that the transaction costs for real estate are so high that people feel that rapid appreciation is needed in order to be able to trade houses later in life (up or down). Cutting into high realtor fees, title fees, loan origination fees, transaction taxes, etc is severely needed.

Two points that I think bear making:

1. Saying that housing is a poor investment by comparing housing returns to the S&P 500 (for instance) doesn't account for the fact that house buyers are extremely leveraged, often paying only 10% to 20% down. Most stock investors are not similarly leveraged and wouldn't even be permitted by their brokers to be so leveraged. Once the leverage is taken into account, the "return on investment" for the housing down payment becomes much more attractive (and housing prices seem much less volatile than the S&P 500, which makes the leverage even more attractive).

2. I think that house buyers *do* benefit from rising house prices (and see this benefit) in that the ultimate end-game is to sell one's big house and down-size later in life, taking a much bigger profit.